You may have received, or have been asked to download, information about annuities produced by someone who doesn’t sell them or doesn’t believe you should buy or own them. Much of this information is misleading; some of it warrants four Pinocchios! The information provided on this page is intended to give you the facts behind the negative sales pitch. Facts are empowering! You can make informed decisions about your financial goals and retirement plan! But, before we get to the facts, it is necessary to clarify that fixed annuities are NOT investments. Fixed annuities are insurance products and have the insurance guarantees of:

- Predictable income you cannot outlive

- Protection from investment and market risk

- Minimum interest earnings – in every economic climate

In fact, annuities should be considered the same way you consider life insurance – both accumulate interest, but:

LIFE INSURANCE protects your family if you die too soon, and ANNUITIES protect you from outliving your income if you live “too long”.

Whereas investing can indeed be a risky and scary business, annuities provide the simple promise and the safety of the insurance guarantee that your fixed annuity will not suffer any losses because the markets do.

Fixed annuities are bought for a variety of reasons, including saving money for retirement, saving money for business partners, loved ones, or charities at death, and saving for planned and unplanned expenses. Fortunately, in the annuity market place there are products to meet every consumer’s preferences and unique financial objectives.

That said, not all financial products are right for everyone, nor should everybody’s money be trusted to just one type of financial product. However, annuities can and do play an important role in helping many Americans save and prepare for retirement. In fact, most annuity owners agree, because 9 out of 10 annuity owners believe that annuities are an effective way to save for retirement1.

Despite this clear endorsement, questions and misunderstanding persist regarding the benefit of annuities as an effective planning tool for retirement. We address a number of these questions in the sections that follow.

- What kinds of returns can I expect with an annuity?

There are two types of annuities – fixed and variable. Variable annuities earn investment returns based on the performance of the investment portfolios, known as “subaccounts,” where you choose to put your money. The return earned in a variable annuity isn’t guaranteed. If the value of the subaccounts goes up, you could make money. However, if the value goes down, you could lose money. Also income payments to you could be less than you expected.

Fixed annuities earn interest and not “returns.” This is an important distinction because investments earn returns and a rate of return calculates investment losses as well as investment gains. Life insurance and fixed annuities earn interest. Since there are NO investment losses in an insurance product like fixed annuities, the use of “return” is confusing and misleading. Unfortunately, mixing up these two distinct concepts is a common mistake made by those who don’t sell or understand fixed annuities and who, perhaps, make their living selling risk‐based investments.

With fixed deferred annuities, the insurance company either calculates and determines the interest to be credited based on the insurance company’s earnings (for set or declared rate annuities) or based on the positive performance of a market index (for indexed annuities). The National Association of Insurance Commissioners, which regulates fixed annuities, considers both products FIXED annuities, regardless of how interest is calculated. All fixed annuities, including indexed rate and declared rate annuities, guarantee you will not suffer losses because the markets do.

- Is it true that indexed annuities can limit how much interest I earn?

The main difference between fixed indexed annuities and other forms of fixed annuities is the way interest is calculated. And, just as you don’t receive all of the positive earnings from the insurance company investment portfolio in a declared rate annuity, you do not earn all of the positive index performance in an indexed annuity. The insurance company must pay for the insurance guarantees of the annuity, as well as the usual and customary company expenses to develop, market, and service the annuities sold. Insurance companies use participation rates and caps in indexed annuities to pay for these expenses and ensure profitability.

A participation rate or a cap can be raised up or down, reflecting current market and economic conditions. During strong economic times these rates and caps will be higher; during weak or negative economic times, they will be lower. This flexibility is advantageous for the consumer: the annuity contract adapts to market conditions while also being protected with minimum guarantees and suffering no losses because the index change is negative.

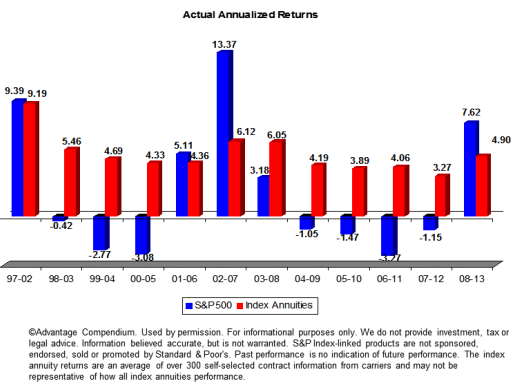

Sometimes folks that “hate” annuities like to show “hypothetical” performances of an indexed annuity by cherry picking economic cycles or other market variables. But, since indexed annuities have been sold for almost 20 years, we have studies that review ACTUAL interest earnings paid into the annuity contract using a statistical sample of over 300 real‐life indexed annuity contracts. NAFA encourages you to read the full academic paper called, “Real‐World Index Annuity Returns.”2 The authors of this study are often called upon to discuss real, historical scenarios, not hypothetical examples using select periods, explaining how fixed indexed annuities actually perform for their owners.

- Okay, so please explain about the kinds of expenses associated with the annuity?

It is common for those who do not sell fixed annuities and engage in negative advertising about annuities to confuse concepts and features between fixed and variable annuities. Both types of annuities can play a role in financial and retirement planning, but it is important to understand the differences between the two products. Fixed annuities have charges (called surrender charges) that are made ONLY when you take money out of the annuity. Most fixed annuities allow you to take a certain amount of money without paying any charges, but if you take more, the amount over the maximum will be charged a penalty. Also, if you terminate your annuity contract early, before the charges have expired, you will pay a surrender charge. All charges, and under what conditions they are imposed, must be clearly explained in the documents you receive both before and after you purchase the annuity. Fixed annuities may also offer riders that provide additional benefits and features, and you may be charged for those riders. All insurance companies are required by law to fully disclose all charges and under what circumstances they may be incurred. This information must be disclosed both before you buy the annuity and in the insurance policy you receive from the insurance company. Also, unlike investment products, all annuity policies issued come with a money‐back guarantee, called a “free‐look period,” during which time you can return and cancel the policy and receive ALL of your premium back. This is an insurance guarantee and consumer protection that investment products do not provide.

- Can you explain why there are surrender charges?

The insurance guarantees of complete protection from market losses, income for life, minimum interest, and additional interest above the minimum are not free and are an expense to the insurance company. As with any company, there are other costs of business, including; regulatory compliance, mandated reserving, product development, marketing, and servicing annuity customers. In order to pay for the expenses and the mandated reserves required to remain a solvent and a viable business, the insurer invests the premiums it receives. However, like any investment, it can only cover the expenses and profit requirements if it retains the investment for a sufficient period, often several years. If an annuity contract is cancelled too early, these expenses will more than likely be greater than their investment returns, and the insurance company will suffer a loss.

It is left to the insurance company to determine prevention measures to avoid a loss. All prudent buyers of financial products want their company to operate at a profit. So, the question becomes, what do you consider the fairest loss prevention method? Some methods assign the cost of offsetting the potential loss to all buyers, whether they surrender their contracts early or not. By contrast, the surrender charge method imposes the burden of repaying unrecovered expenses only to those who caused the loss by not fulfilling the contractual obligation.

There are fixed annuities with no surrender charge and some with 12‐year surrender charges— and everything in between. Surrender charges must be properly explained and understood by the consumer considering purchasing an annuity. Surrender charges are the best tools for ensuring that ALL consumers receive the most competitive interest rate and annuity features possible and that the insurers are adequately protected from a “run on the bank.”

- Is it true that many income riders are beneficial only if the annuity performs poorly and that they require turning my annuity into a stream of income payments?

When you hear or read about income riders, it is extremely important to understand what information is applicable to variable annuities and what information is applicable to fixed annuities. Variable annuities have market risk, and the value of the subaccounts chosen could go up or down. If they go up, you could make money. If they go down, you could lose money. Also, income payments to you could be less than you expected.3 By contrast, many fixed indexed annuities have a baseline income guarantee, and you can also utilize performance of the annuity to increase the guaranteed income exponentially.

Fixed indexed annuities available today do not require annuitization on their income riders. These income riders for fixed annuities (typically called Guaranteed Lifetime Withdrawal Benefit riders) provide a guaranteed income stream, typically a percentage of the premium, but the income stream lasts your entire life, even if your annuity account value falls to zero. Most income riders allow you to turn the income payments on and off or take out the money remaining in your annuity that has not been paid out or withdrawn by you. An income rider should not be confused with annuitization, available in all fixed deferred annuities, which guarantees the amount you will be paid and guarantees that you can receive those payments as long as you live. The key difference between an income rider and annuitization is that with the income rider you still own and have control of the annuity account value. With annuitization you convert all value to a promised payment stream.

- I’ve heard that annuities pay “high commissions”‐ is that true?

Insurance companies pay the annuity salesperson for the sale of an annuity. They are paid when your policy is issued and accepted by you. However, the payment isn’t taken out of premium, and the commission payment isn’t taken out of the amount you pay into the annuity. Commissions paid once on the sale of a fixed annuity are often, over time, less than the ongoing management fees charged to your investment account. Fees paid to your investment firm are taken out of the assets they manage on your behalf. The SEC4 advises that “before you hire any financial professional—whether it’s a stockbroker, a financial planner, or an investment adviser—you should always find out and make sure you understand how that person gets paid when they sell securities. Investment advisers who sell securities or security products generally are paid in any of the following ways:

- A percentage of the value of the assets they manage for you;

- An hourly fee for the time they spend working for you;

- A fixed fee;

- A commission on the securities they sell (if the adviser is also a broker‐dealer); or

- Some combination of the above.”

Depending on your needs and preferences, insurance commissions or any of the above compensation methods have potential positive and negative benefits, all of which should be considered when choosing financial products and the professionals who sell them.

- I’ve heard that FINRA and the SEC have reported that there are a lot of consumer complaints with annuities and that the insurance companies reserve the right to change the terms of the contract?

The SEC report you may be referring to was issued in 2004—over a decade ago—and the complaints were related to variable annuities. Since then, complaints have plummeted to such an extent that neither insurance nor annuity products are mentioned as a concern in the 2014 FINRA Regulatory and Examination Priorities.5 Instead, FINRA warns investors to be wary of advisors pushing interest‐rate‐sensitive securities, such as mortgage backed securities and long duration bonds, bond funds and ETFs. In 2013, there was one annuity complaint for every $200 million of paid fixed annuity premium. Fixed indexed annuities, the product most fixed annuity detractors “hate,” recorded approximately 6.5 billion new policies issued since they were first introduced and less than ½ of 1% have filed complaints.6 Also, FINRA regulates securities products, so referencing FINRA when talking about fixed annuity products is problematic and misleading.

Insurance law requires that any limitations on future premiums or change in terms must be clearly described in the annuity contract. Insures don’t “reserve the right” to change anything. Any non‐guaranteed feature must be clearly identified in the advertisement, disclosure, sales material AND contract.

Consumers who are considering any financial product or insurance contract should read what they are purchasing. Whether it’s a prospectus for a security or a contract for insurance, the consumer should fully read it before they sign. In addition, the annuity purchaser should be aware of all the annuity contract’s benefits and limitations and read the contract, ask the professional selling you the annuity, and/or call the company that issues the annuity you are considering.

- Do I pay extra for tax‐deferred status of an annuity, and what happens when I die?

The tax deferral of a fixed annuity is granted by the United States government and is imbedded in the IRS Code. The “cost” of deferring the tax is not borne by the insurance company issuing the annuity or the annuity owner.

Tax deferral for annuities can provide a powerful boost to annuity earnings over other financial products that don’t receive tax‐deferred status. After all, the tax‐deferred money that is NOT paid every year in taxes stays in the annuity, and it earns interest as well as does the premium you paid. The power of tax deferral is clear, and, with higher interest rates, higher tax brackets, and longer maturities, the power of tax deferral becomes even more powerful! If you own an annuity in an IRA or employer‐sponsored retirement plan (called qualified plans), the annuity’s tax deferral provides no more tax advantage than what you receive using other products in your qualified plan, but it provides no less either. All annuities purchased using after‐tax dollars (called non‐qualified annuities) enjoy the same tax‐deferred advantage.

Tax deferred is not the same as “tax free.” Income from tax‐free investments, such as most municipal bonds, incurs no income taxes on gains. The interest earned in non‐qualified tax‐deferred annuities (and interest plus premium paid for qualified annuities) is taxed when you take out the money.

It is important to understand that your annuity will transfer to your survivors free from probate, saving time and legal fees. Your survivors will have to pay taxes and will need to consider tax issues. NAFA advises consulting with a tax professional to help manage the tax impact of an annuity inheritance. Any inheritance, whether it is an annuity’s death benefit or investment returns, have income, capital gains and inheritance tax considerations, so be careful when someone suggests annuities are unique in this consideration.

- How does inflation impact my annuity income and are there ways I can address it?

Inflation is a risk on any fixed income recipient, and if you believe inflation will be high during your retirement, NAFA encourages you to address this with your annuity professional or investment advisor. It is good to know, too, that there are many “inflation adjusted” annuities available on the market today. If you are concerned about inflation risk, ask your annuity professional about an inflation‐adjusted annuity. Also, in a deferred annuity, where you defer your payout until sometime in the future, you may select products with competitive and inflation‐adjusted payouts at the time you begin your income payments. Ask your insurance professional for more information.

In Summary

Both accumulation goals and retirement income goals need to be addressed to ensure you enjoy the retirement you envision. NAFA believes retirement planning isn’t an either/or option. In fact, many Americans own both annuities and investments in an effort to diversify their market risk and to ensure guaranteed and insured income in retirement.

In closing, we offer these FOUR POINTS OF CAUTION regarding offers by firms who “HATE” or “DON’T SELL ANNUITIES”:

Read the fine print of the offer and ask –

- What is the minimum amount they expect from you to invest?

- What are the limitations and rights to cancel or modify their offer to convert your annuity?

- How will any reimbursement of surrender charge be made? Will they pay it immediately, over time or through a credit of their normal advisory fees?

- Are you willing to lose some or all of your money in a risk‐based investment?

NAFA is the authority on fixed annuities. Our mission is to promote the awareness and understanding of fixed annuities. NAFA educates annuity salespeople, regulators, legislators, journalists, and industry personnel, about the value of fixed annuities and their benefits to consumers. NAFA’s membership represents every aspect of fixed annuity marketplace covering 85% of fixed annuities sold by independent agents, advisors and brokers. NAFA was founded in 1998.

Quick reference links:

www.FixedAnnuityFacts.org

www.annuityed.org

www.indexedannuityinsights.org